As a business owner or manager, you want to ensure that your business is protected from future compliance issues and your employees are compensated fairly. However, managing employee tips can be a complex and time-consuming process that can lead to compliance issues and financial penalties if not reported or submitted correctly. This is where CloudApper’s Tip Management solution comes into play, and it’s especially important for UKG users to ensure compliance with IRS regulations.

The Benefits of CloudApper Tip Management Solution for UKG Users

Compliance With IRS Regulations

One of the biggest advantages of CloudApper Tip Management Solution for UKG users is that it ensures compliance with IRS regulations for tip tracking and reporting. The software’s real-time updating of tip data ensures that businesses remain in compliance with IRS requirements, reducing the risk of financial penalties and tax fraud.

Time-saving and Efficient

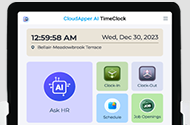

CloudApper Tip Management Solution streamlines the process of tracking and managing employee tips data, replacing time-consuming and error-prone manual data entry. Managers can easily record tip data for a large number of employees at once or individually, and employees can simply report their tips at the end of their shift. The solution’s user-friendly interface makes it easy for managers to keep tabs on and manage their staff’s tip data with minimal effort.

Seamless Integration With UKG

CloudApper Tip Management Solution integrates effortlessly with UKG’s offerings, ensuring a seamless and hassle-free experience for users. Employers can rest assured that they are in compliance with IRS standards for tip tracking and reporting, without worrying about the burden of manual updates or tax fraud.

How Does CloudApper Tip Management Solution Work?

CloudApper Tip Management Solution is designed to simplify the process of tracking and managing employee tips data for UKG users. Here’s how it works:

-

Employee Declares Tips

At the end of their shift, employees can easily report their tips to their managers using CloudApper’s simple and user-friendly method for reporting gratuities.

-

Manager Verifies Information

The manager reviews and confirms the accuracy of the tips data provided by the employee, ensuring that it is in compliance with IRS regulations.

-

Enter Tips Into CloudApper

The manager (or the employee) inputs the amount of the tip into CloudApper, either individually or in bulk for multiple employees. The software’s user-friendly interface makes it easy for managers to input and manage tips information.

-

Automatic Update

CloudApper Tip Management Solution automatically updates the tip data in UKG Dimensions, ensuring compliance with IRS requirements. This eliminates the need for users to manually enter data into UKG Dimensions, reducing the risk of human error and ensuring the reliability of the resulting tips data.

Conclusion

In conclusion, accurate tip management is essential for businesses to protect themselves and their employees from compliance issues and financial penalties. CloudApper’s Tip Management Solution provides UKG users with a user-friendly and efficient way to track and manage employee tips data while ensuring compliance with IRS regulations. With CloudApper, UKG users can streamline their tip management process, saving time and reducing the burden on managers. So, what are you waiting for? Contact us today!