If you’re in the service sector, your employees typically receive tips from customers by providing them with outstanding services. While tips are a valuable source of income for your employees, they also come with a variety of legal and financial responsibilities for your organization. One of these responsibilities is accurate tip recordkeeping, which is mandated by the IRS and can ultimately help you with tax compliance and fraud prevention. Let’s explore the importance of employee tip recordkeeping and how UKG customers can simplify it with CloudApper’s Employee Tips Management Solution.

Importance of Employee Tip Recordkeeping

Employee tip recordkeeping is crucial for any organization that has tippable employees. That’s because the IRS requires employers to keep accurate records of tips received by their employees – tips are part of any employee’s income and are taxable. As a result, if employers don’t have accurate tip records, then they might be applicable for higher taxes. Moreover, failure to keep accurate records of employee tips can result in fines and penalties.

In addition to legal requirements, accurate tip recordkeeping is also essential for preventing fraudulent tip reporting. Without proper recordkeeping, employees may be tempted to underreport their tips or fail to report them at all. As mentioned previously, this can lead to employers paying higher taxes, and if any discrepancies are found, then both the employees and employers are applicable for fines and penalties.

For UKG customers with tippable customers, however, CloudApper brings the perfect solution to ensure accurate tip recordkeeping.

CloudApper’s Employee Tips Management Solution for UKG Users

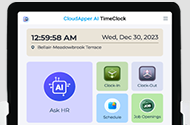

To help UKG customers simplify their employee tip recordkeeping, CloudApper has developed the Employee Tips Management Solution. This solution is fully integrated with UKG, making it easy for the solution to send the tip data to UKG directly.

With CloudApper’s Employee Tips Management Solution, employers can easily record employee tips. The solution provides a simple and intuitive interface for managers to enter tip data, and it also has an audit log to keep track of all the records and their updates. Moreover, managers can enter tip data in bulk. For instance, ten employees received $50 each as tips. With CloudApper, the manager can simply select the employees and enter the tip amount once – CloudApper sends the tip data for the selected employees accurately to UKG – eliminating the need for additional steps.

Conclusion

Employee tip recordkeeping is essential for organizations employing tippable workers. Moreover, IRS requires organizations to accurately record tip amounts. With CloudApper’s Employee Tips Management Solution, UKG customers can simplify their tip recordkeeping, reduce the risk of fraudulent reporting, and ensure tax compliance – contact us now to help simplify tip recordkeeping for your organization.