As a UKG customer, keeping up with IRS regulations is essential for maintaining accurate records of employee tips. Failing to do so can lead to legal and financial consequences that can harm your business in the long run. In this article, we will guide you through the key aspects of IRS regulations related to employee tip management and how CloudApper’s Tip Management solution can help you stay compliant.

Importance of Tip Recordkeeping for IRS Compliance

According to IRS regulations, any employee who receives tips that exceed $20 in a calendar month must report them to their employer. The employer, in turn, is required to keep proper records of these tips, including the amount, date, and time received, as well as the employee’s name and Social Security number. These records must be kept for at least three years and be available for inspection by the IRS upon request.

Failing to comply with these regulations can lead to severe consequences, including audits, penalties, and legal action. In addition, employees who do not report tips accurately may also be subject to penalties and fines.

How CloudApper’s Tip Management Solution Can Help

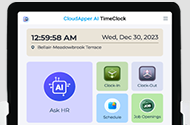

Managing employee tips can be a time-consuming task, especially for organizations with a large number of tippable employees. CloudApper’s Tip Management solution for UKG customers simplifies this process by automating the tip declaration process during employee punches or allowing managers to enter the amount of tips each employee receives.

With the help of our solution, UKG customers can easily keep track of the tips each employee receives, automatically updating the information in real-time to UKG’s Dimensions system. This ensures compliance with IRS regulations, reducing the risk of audits and penalties. In addition, our solution provides transparency and fairness for all employees, ensuring that each tip is accurately recorded.

How Does CloudApper Tips Management Solution Work?

CloudApper Tips Management Solution streamlines the process of tracking and managing employee tips data for UKG users. Here’s how it works:

- Employee Declares Tips: At the end of their shift, the employee reports their daily tips to the manager.

- Manager Verifies Information: The manager verifies the tip information provided by the employee.

- Enter Tips into CloudApper: Once the manager has verified the data, they enter the amount into CloudApper.

- Automatic Update: CloudApper automatically updates the tip data in UKG, ensuring compliance with IRS regulations.

Avoiding Common Pitfalls in Tip Management

One of the most common pitfalls in tip management is failing to keep accurate records of employee tips. This can happen when employers rely on manual data entry, which is prone to errors and can be time-consuming. Using CloudApper’s Tip Management solution, UKG customers can avoid this pitfall by automating the tip declaration process and allowing for real-time updates to UKG’s Dimensions system.

Another common pitfall in tip management is failing to include all taxable tips in employee paychecks. According to IRS regulations, all tips received by an employee must be included in their gross income and be subject to federal income tax, Social Security tax, and Medicare tax. Employers who fail to include all taxable tips in employee paychecks can face penalties and legal action. With the help of our solution, UKG customers can easily ensure that all taxable tips are included in employee paychecks, reducing the risk of penalties and legal action.

Conclusion

Keeping up with changing IRS regulations related to tip income can be a challenging task for UKG customers. However, with the help of CloudApper’s Tip Management solution, employers can simplify the process of managing employee tips, ensuring compliance with IRS regulations and avoiding legal and financial consequences. By automating the tip declaration process and allowing for real-time updates to UKG’s Dimensions system, our solution provides transparency and fairness for all employees. To learn more about how CloudApper can help you stay compliant with IRS regulations, contact us today.